- QUICKBOOKS ACCOUNTANT ONLINE SELF EMPLOYED FULL

- QUICKBOOKS ACCOUNTANT ONLINE SELF EMPLOYED SOFTWARE

- QUICKBOOKS ACCOUNTANT ONLINE SELF EMPLOYED TRIAL

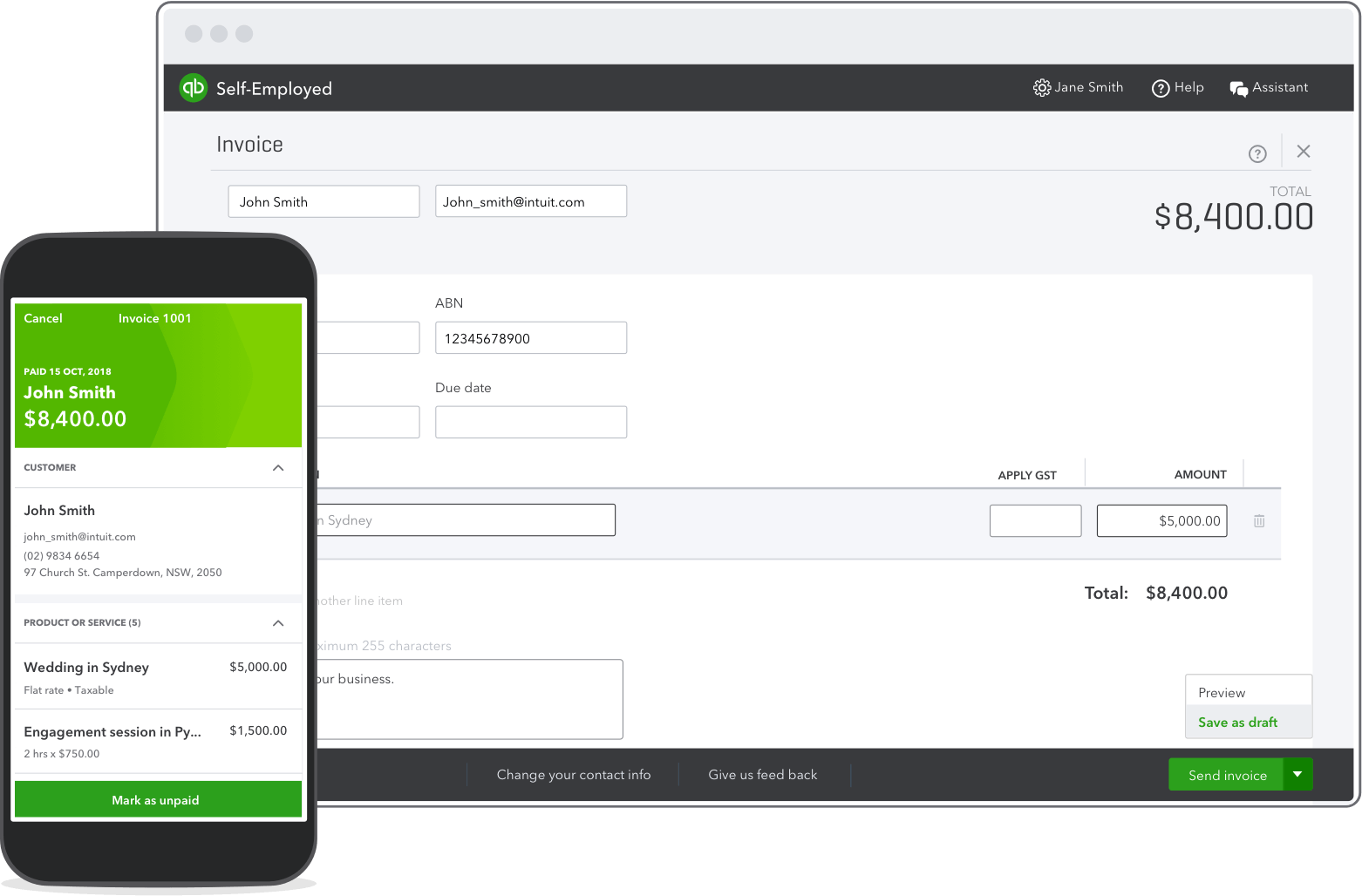

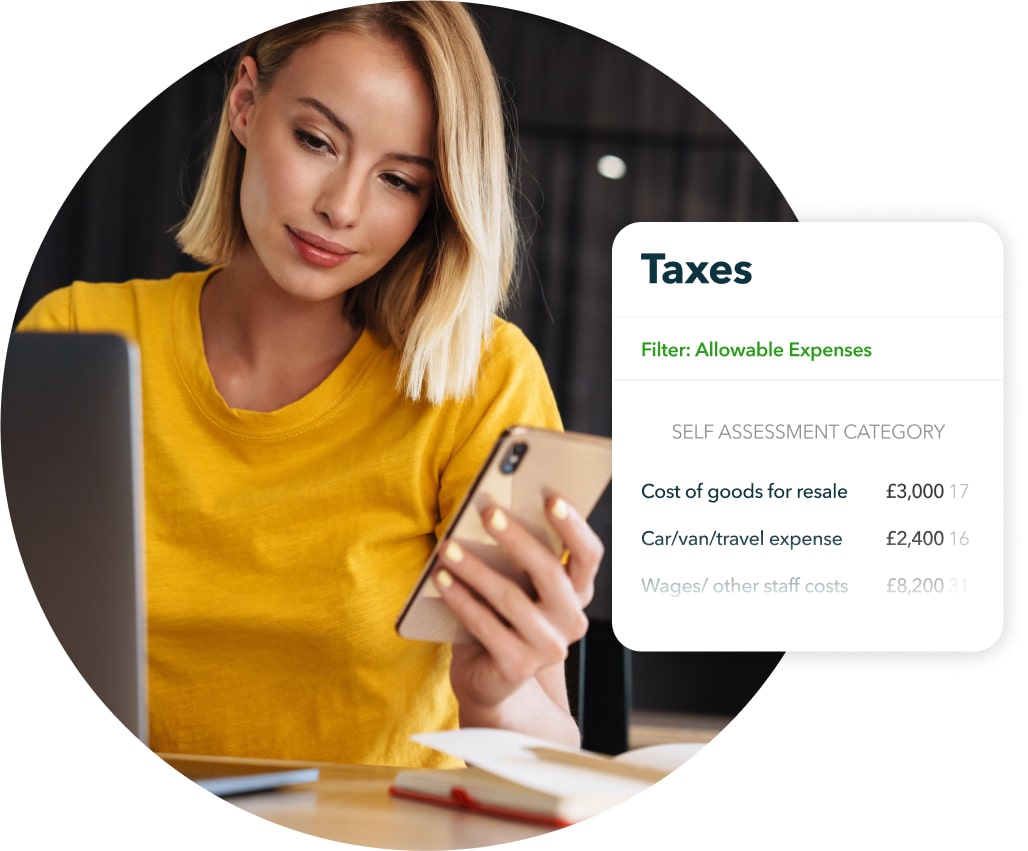

Instead of using a separate software or app to send invoices to clients, you can send them instantly from QuickBooks Self-Employed. If you’re using the Intuit QuickBooks Self-Employed mobile app, you can let it track your mileage automatically by turning on Location Services. These six seem sufficient considering the scope of the site, though GoDaddy Bookkeeping offers more reports beyond taxes, as well as a Schedule C Worksheet.

QuickBooks Self-Employed also has mobile apps available for Apple products (iOS 13.0+) and Androids (6.0+).

Be sure to visit the QBO website for a discount on QuickBooks payroll.īefore you go, I hope this article about, ‘How much does QuickBooks accountant online cost?’ is helpful for you.As cloud-based software, QuickBooks Self-Employed is compatible with nearly any computer that has an internet connection. Intuit often runs payroll promotions for existing QuickBooks Online and for modern QuickBooks users. QuickBooks Online payroll costs between $ 45- $ 125 / month plus $ 4- $ 10 / month per employee. With its full-service payroll option, QuickBooks does it all for you. The self-service payroll option requires you to run the payroll and file your payroll taxes yourself.

QUICKBOOKS ACCOUNTANT ONLINE SELF EMPLOYED FULL

QuickBooks Online offers two types of payroll: payroll and full service payroll. You must know exactly how much QuickBooks Online will cost before committing to your plan.

Intuit is not always concerned about these additional fees, so we want to highlight them now. In addition to the monthly subscription price, there are a few other QuickBooks Online charges to consider. These services are important to the growth of any business, and as such an accountant is an essential addition to the staff of any performance-oriented business. They also provide financial advice, auditing, tax planning, and business consulting services. They are expected to analyze and plan the financial aspects of the business. As a result, there is a different set of benefits for the QuickBooks Counter.Īccountants are responsible for all accounting work in a company or business. Well, while there are great similarities in the roles these two groups of people perform, there is also a defining difference that sets them apart. Many people are expected to assume that a QuickBooks Accountant is just a regular accountant. The term QuickBooks counter may be new to many. How much does it cost to hire a fast accountant? Also, if you are switching from QuickBooks Desktop to QuickBooks Online, you may be eligible for even better discounts.

QUICKBOOKS ACCOUNTANT ONLINE SELF EMPLOYED TRIAL

Discounts are not valid if a customer uses the 30-day free trial before purchase (a free software test drive that they can use instead of a free trial). QuickBooks almost always offers a discount on their website, so be sure to check any promotions before buying. Payments are made monthly and annual contracts are not required. Each set gives you access to more functions and users. QBO offers four subscription plans, so there is only one price for QuickBooks Online. How much does QuickBooks online cost? It is a more complicated question than you think. Disclosure: This post contains affiliate links and I will be compensated when you make a purchase after clicking on my links, there is no extra cost to you

0 kommentar(er)

0 kommentar(er)